Trump Slaps 125% Tariff on China, Temporarily Eases Trade Pressure on Allies

In a significant escalation of trade tensions, President Donald Trump announced on April 9, 2025 an immediate increase in tariffs on Chinese imports to 125%, citing China’s alleged disregard for global trade norms. Concurrently, he declared a 90-day pause on tariff hikes for other nations, reducing reciprocal tariffs to a universal rate of 10% during this period.

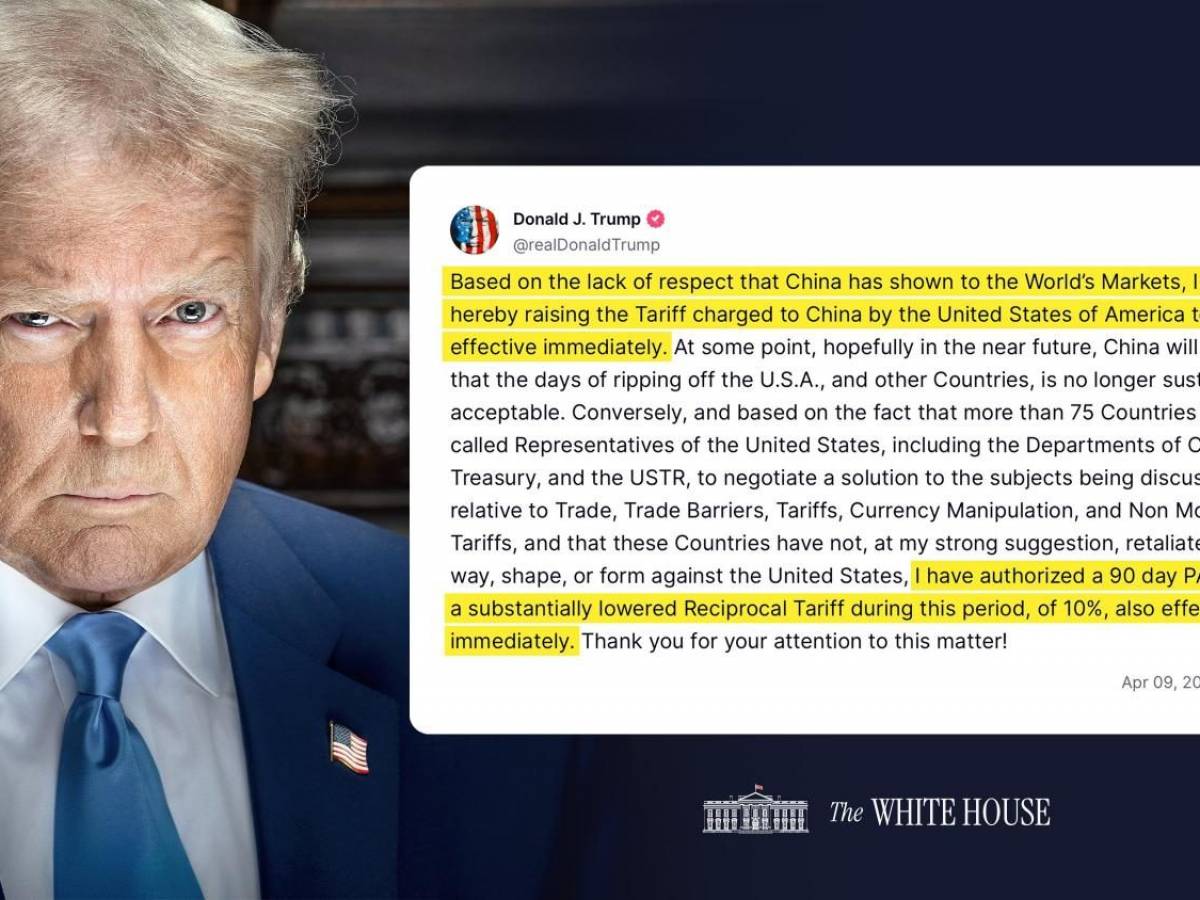

President Trump stated, “Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately.” He expressed hope that China would soon recognize that exploiting the U.S. and other countries is “no longer sustainable or acceptable.” Conversely, he acknowledged that over 75 countries had engaged with U.S. representatives to negotiate solutions on trade barriers, tariffs, and related issues without retaliating. In response, he authorized a 90-day pause with a reduced reciprocal tariff of 10%, effective immediately.

The decision to impose a 125% tariff on Chinese goods marks a sharp escalation in the ongoing trade war between the world’s two largest economies. Earlier that day, China had announced an increase in tariffs on U.S. imports from 34% to 84%, further intensifying the dispute. These tit-for-tat measures have raised concerns among economists and business leaders about the potential for a global economic slowdown.

Financial markets reacted swiftly to the developments. The Dow Jones Industrial Average surged by 2,271 points (6%) to close at 39,916.64, marking its largest intraday gain since 2020. The S&P 500 and Nasdaq 100 also experienced significant increases of 5.9% and 7.7%, respectively. This rally followed earlier declines prompted by fears of escalating trade tensions and their potential impact on global supply chains.

Analysts suggest that the 90-day pause on tariff hikes for other countries may provide a window for diplomatic negotiations aimed at de-escalating trade tensions. However, the substantial increase in tariffs on Chinese goods indicates a hardening stance by the U.S. administration towards China. Treasury Secretary Scott Bessent emphasized that this strategy was devised by President Trump himself, reflecting his commitment to addressing perceived inequities in international trade.

The European Union has also been drawn into the fray, planning to impose retaliatory tariffs on a range of U.S. goods valued at €21 billion, including textiles, food products, and motorcycles. These measures are in response to previous U.S. tariffs on steel and aluminium products. It remains uncertain whether the EU will adjust its approach in light of the latest U.S. policy shifts.

Economists warn that the escalating trade war could heighten the risk of a global recession. The increased tariffs are expected to disrupt international supply chains, raise production costs, and potentially lead to higher prices for consumers. Despite these concerns, President Trump maintains that his administration’s actions are necessary to revitalize U.S. manufacturing and address longstanding trade imbalances.